Keys to the Market

Unlocking Insights, One Door at a Time

How Eco-Friendly Features Can Boost Your Home’s Value

Homebuyers increasingly prioritize eco-friendly features, focusing on energy efficiency to reduce costs and enhance comfort. Upgrades like efficient HVAC systems, insulated windows, and solar panels not only save money but also boost home values, appealing to environmentally conscious buyers and potentially increasing sale prices.

Why More Sellers Are Hiring a Real Estate Agent

More homeowners are realizing they need an agent’s help in this complex market – and that’s why a record-low number of people are selling without a pro by their side. Without an agent’s help, tackling pricing, staging and repairs, paperwork, negotiation, and more can be a real headache. Selling without a pro isn’t worth the hassle. Let’s connect to see if we’d work well together.

What’s Motivating More Buyers To Choose a Newly Built Home?

Newly built homes are increasingly popular, with a 15% market share last year, the highest in 17 years. Key motivations include avoiding renovations, the ability to customize design features, enjoying modern community amenities, dealing with low inventory of existing homes, and benefiting from energy efficiency and smart home technologies. With these advantages, new constructions are appealing not just for their novelty but for practical, financial, and lifestyle benefits, making them a top choice for today's homebuyers.

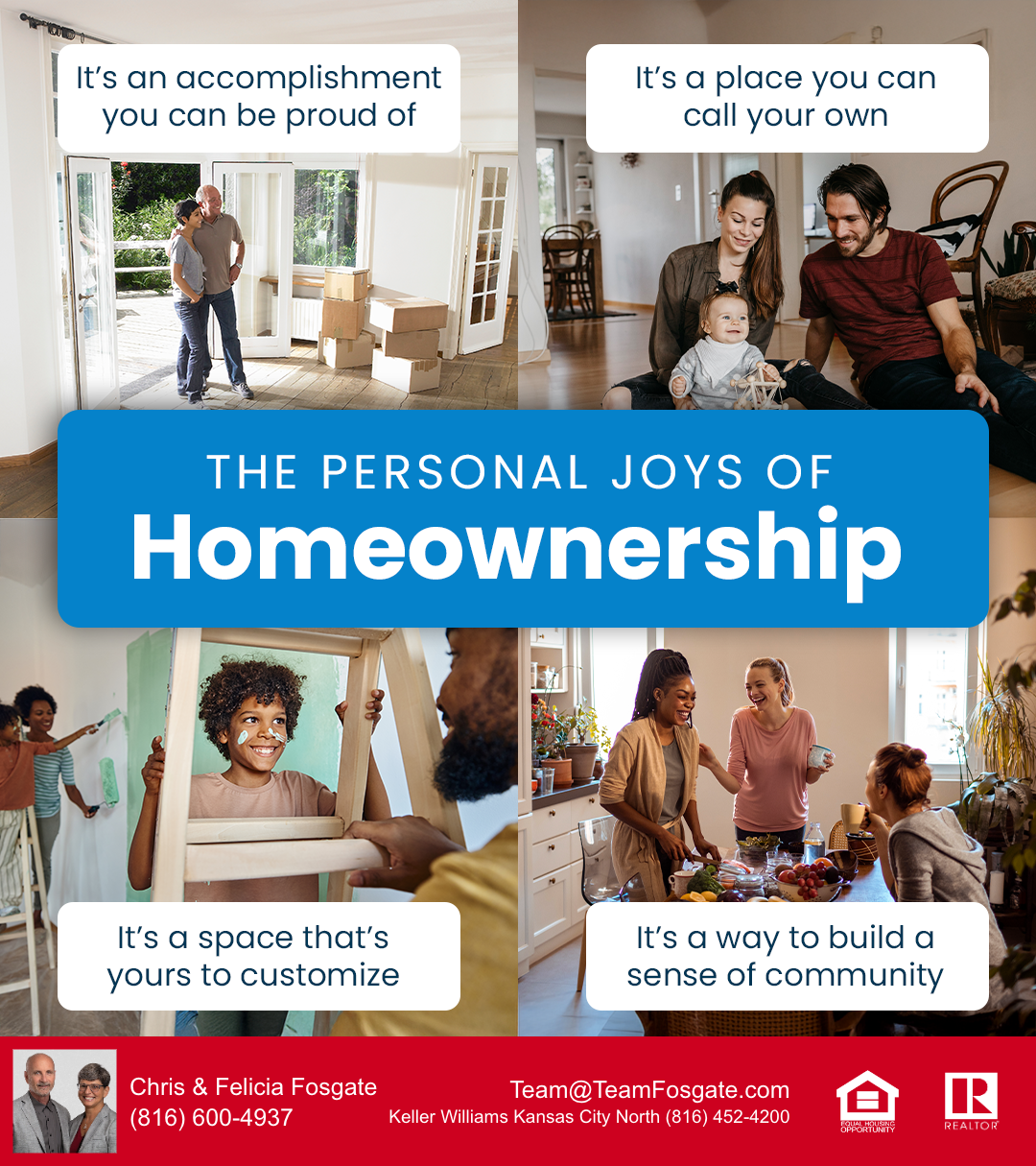

List of Non-Financial Homeownership Benefits

Owning a home is about so much more than just the financial perks. It’s where memories are made, connections are built, and life happens – and this time of year is a great time to celebrate the more emotional benefits that make a house feel like home.

Season’s Greetings from all of us at Team Fosgate Real Estate

Season’s Greetings from all of us at Team Fosgate Real Estate

The #1 Reason People Move: To Be Closer to Family and Friends

Have you ever thought about packing up and moving to be closer to the people who mean the most to you? Maybe you’re tired of long drives to see your family or wish your kids could spend more time with their grandparents. Clearly, a lot of other people feel the same way.

How Home Equity May Help You Buy Your Next Home in Cash

Homeowners are experiencing high equity levels, with many having at least 50% equity, averaging around $311,000. This significant financial advantage is enabling an increasing number of buyers to purchase their next home in cash, avoiding mortgages and interest payments. Understanding your home's equity through a professional assessment can reveal opportunities for buying outright or making substantial down payments, thus simplifying and enhancing your next real estate transaction.

The Truth About Down Payments

There’s a misconception going around that you have to put 20% of the purchase price down when you buy a home. But the truth is, many people don’t put down that much unless they’re trying to make their offer more competitive. And if you want to give your savings a boost, look into down payment assistance. There are thousands of programs that offer an average benefit of nearly $17,000. To learn more about loan options or down payment assistance programs, connect with a trusted lender and check out downpaymentresource.com.

Struggling To Sell Your House? Read This.

Struggling to sell your house? Key factors like overpricing, lack of staging, and restricted viewing times can hinder sales, even in a seller's market. Expert agents can guide price adjustments, enhance presentation, and improve accessibility to attract potential buyers, increasing the likelihood of a successful sale.

The Biggest Perks of Buying a Home This Winter

Winter home buying comes with perks like reduced competition, giving buyers more time to consider their options and negotiate. Sellers are often more motivated, possibly leading to lower prices, with homes approximately 5% cheaper compared to summer, enhancing affordability.

More Starter Homes Are Hitting the Market

The inventory of entry-level homes, or starter homes, is on the rise, marking a significant shift for first-time buyers. With a 26.2% increase in overall home listings compared to last year, opportunities for affordable homeownership are expanding. Experienced real estate agents play a crucial role in navigating this growing market, offering guidance on listings, pricing, and negotiations to ensure first-time buyers find and secure homes within their budget.

Only an Expert Agent Can Give You an Accurate Value of Your Home

Automated online home valuation tools often fail to capture the full picture, missing crucial details like the home's condition and local market trends. Expert real estate agents bridge this gap with comprehensive assessments, including walk-throughs and current comparable sales data. For the most accurate home value estimate, partnering with a knowledgeable agent ensures you consider all unique factors and receive tailored insights based on real-time market conditions.

What Homebuyers Need To Know About Credit Scores

Data shows 7 out of 10 prospective homebuyers don’t know the minimum credit score required by lenders or that it varies by lender and loan type. According to Experian, the range is anywhere from 500 to 700 for the minimum credit score. That means you don’t need perfect credit to buy a home. Your credit score is important – but that doesn’t mean it needs to be perfect. Work with a lender to learn more about home loan options that may work for you.

The Top 2 Reasons To Look at Newly Built Homes

The availability of newly built homes is increasing, now constituting nearly 29% of the market, offering fresh options for buyers struggling with low existing home inventory. Additionally, builders are responding to affordability concerns by constructing smaller, more budget-friendly homes. Partnering with a knowledgeable real estate agent ensures you navigate builder contracts effectively, enhancing your opportunity to find a home that meets both your needs and budget.

Why Moving to a More Affordable Area Makes Sense

As living costs rise, relocating to more affordable areas offers a viable solution for financial relief. Lower housing costs, insurance premiums, and daily expenses are significant draws. Working with a knowledgeable real estate agent ensures you find a home that suits your budget and lifestyle needs, providing a fresh start and improved quality of life amidst economic pressures.

What Will It Take for Prices To Come Down?

Despite hopes for a drop in home prices, the current market conditions suggest stability due to a persistent imbalance in supply and demand. The U.S. faces a significant housing shortfall, with demand outstripping the available supply, a trend exacerbated by years of underbuilding post-2008 crisis. Experts predict that while home prices may continue to rise, the growth will likely slow to a healthier pace next year. Local market variations do exist, underscoring the importance of consulting with a real estate expert to navigate these dynamics effectively.

Why More Sellers Are Hiring Real Estate Agents

The trend of homeowners opting for real estate agents rather than selling independently as "For Sale by Owner" (FSBO) is increasing due to the complexities of today’s market. Data from the National Association of Realtors indicates a decline in FSBO sales, highlighting the value of expert guidance in pricing accurately and managing legal paperwork. Real estate agents leverage their market knowledge and experience to streamline the selling process, ensuring competitive pricing and compliance, thus facilitating a smoother transaction.

Why This Winter Is the Sweet Spot for Selling

Thinking about selling your house? Here are a few reasons why you may want to do it this season. Buyers looking right now are serious about moving and the number of homes for sale is typically lower this time of year – helping your house stand out. While inventory is higher this year than it’s been in the last few winters, you'll still be in this year’s sweet spot.

Why Owning a Home Is Worth It in the Long Run

Despite today's fluctuating mortgage rates and rising home prices, the long-term value of homeownership remains strong. Historical data shows significant appreciation in home values over the past decades, with average national increases of over 320% in 30 years. This growth underscores the potential for substantial wealth accumulation through real estate, making a compelling case for buying a home even in a complex market.

When Will Mortgage Rates Come Down?

Mortgage rates are anticipated to stabilize and slightly decrease in 2025 after recent volatility. Factors like inflation, unemployment, and new government policies will influence these rates. While precise predictions are challenging, staying informed through trusted experts and focusing on personal financial readiness can help you navigate future home purchases effectively.